Aadhar connecting is required for applying Income Tax returns and many more things The Income Tax Department permits you to connect Aadhaar with PAN through its true site . You can likewise match PAN with Aadhaar through SMS or by visiting the closest PAN specialist organization focus. The cutoff time for PAN Aadhaar connecting 31st March 2022, post which you’ll be charged a punishment measure of up to Rs 1,0000.

Here are the instructions an aide that will assist you with connecting PAN with Aadhaar card.

There are two easy ways to link these two identities.

- visit http://www.incometaxindiaefiling.gov.in and complete the procedure. Alternatively, one can SMS 567678 or 56161 from your registered mobile number in the format:UIDPAN<SPACE><12 digit Aadhaar

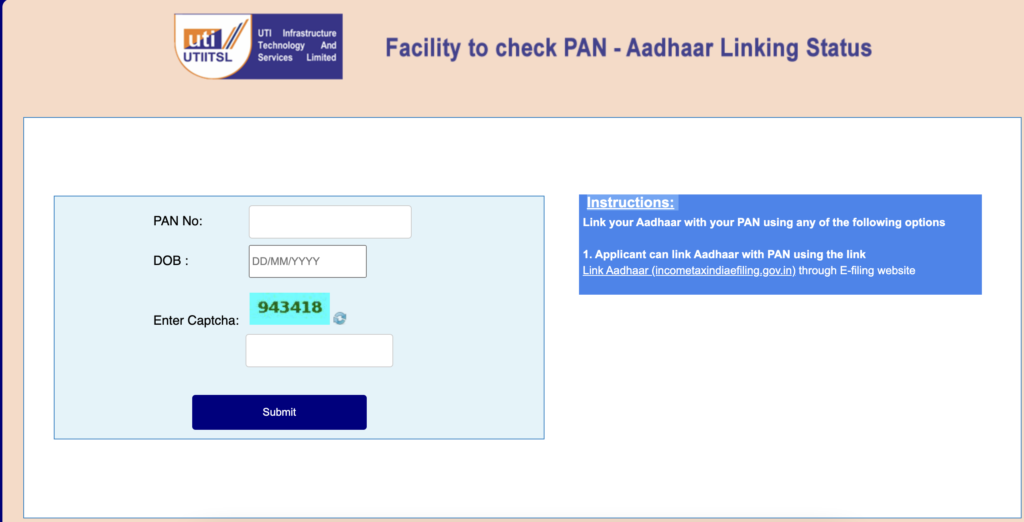

- 10 digit PAN Example: UIDPAN 123456789123 ABCDE1234M. One can check status of linkage of PAN with Aadhaar by visting https://www1.incometaxindiaefiling.gov.in/eFilingGS/Services/Aadhaar

- After deciding to link the two by bringing in a provision in the Finance Act, 2017, the government has extended the deadline a number of times, with latest ending on Wednesday. Section 139AA of the I-T Act states, “Failure to intimate the Aadhaar number, the Permanent Account Number allotted to the person shall be made inoperative after the date so notified.” Use of an inoperative PAN can cost dearly.