SBI ATM cash withdrawal: New rules from today. Know details

SBI OTP-based ATM cash withdrawal facility rules changing from September 18 –These are the benefits

SBI customers will now be able to make ATM withdrawal of Rs 10,000 and above after an OTP verification throughout the day.

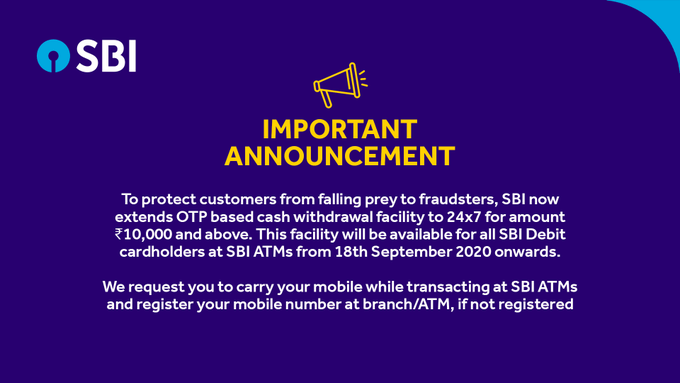

New Delhi: India’s biggest lender State Bank of India (SBI) has announced extension of time for the OTP-based cash withdrawal from ATMs, thus giving the customers a wider window period from Friday (September 18).

SBI customers will now be able to make ATM withdrawal of Rs 10,000 and above after an OTP verification throughout the day.

The bank had allowed this facility to customers during 8 PM to 8 AM in January.

How does OTP-validated ATM transaction work?

The OTP-validated ATM transaction was introduced to minimise the number of unauthorised transactions, State Bank of India had said.

With the introduction of its OTP-based cash withdrawal facility, State Bank added another layer of security for cash withdrawals through its ATMs service.

OTP would be received on the customer”s mobile number registered with the bank. This additional factor of authentication protects State Bank card holders from unauthorized ATM cash withdrawals

Who can avail the services?

This facility will not be applicable for transactions, where a State Bank card holder withdraws cash from another bank’s ATM. It is because this functionality has not been developed in National Financial Switch (NFS), as per SBI. NFS is the largest interoperable ATM network in the country and it manages more than 95 per cent of the domestic interbank ATM transactions.

How to withdraw cash based on SBI OTP Service?

Once the cardholder enters the amount he/she wishes to withdraw, the ATM screen displays the OTP window.

The customer has to enter the OTP received on the registered mobile number to complete the transaction.

Here is how to withdraw cash at SBI ATMs through OTP-based system

-In order to withdraw cash at SBI ATMs, you will need an OTP

-OTP will be sent to your registered mobile number.

-OTP is a system-generated numeric string of characters that authenticates the user for a single transaction.

-Once you enter the amount that you wish to withdraw, the ATM screen will display the OTP screen.

-Now, you will have to enter the OTP received on your mobile number registered with the bank in this screen for getting the cash.

-This additional factor of authentication will protect State Bank card holders from unauthorized ATM cash withdrawals.

-The OTP-based cash withdrawal facility is available only at SBI ATMs as this functionality has not been developed at non-SBI ATMs in National Financial Switch (NFS), the bank said.

Recently, SBI had launched new facility for debit card users to help curb the ATM frauds which have been on the rise. The bank had alerted its customers to be cautious and not to ignore SMS alerts regarding balance enquiry or mini-statement when the request is not initiated by them.